This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

More cash, more profit

Join the Profit First Club Newsletter for Free

Helping entrepreneurs build a profitable and sustainable business without the stress. Insights from the UK’s #1 Profit First Accountancy practice.

29th October 2019 · 1 min Read

The Three Freedoms for Business Owners

Ok, so you’ve made it this far. Well done. You’ve started your own business and it’s successful to some degree. You have regular revenue and […]

25th October 2019 · 4 min Read

How to Submit Your Own Accounts: A Complete Guide

How to Submit Your Own Accounts: A Complete Guide Introduction If you’re a business owner, you might be wondering whether you can submit your own […]

9th October 2019 · 8 min Read

A comprehensive guide of national assurance for self-employed

National assurance for self-employed National Insurance has become a firmly established part of Britain’s taxation system since its inception in 1911. Today it forms the […]

11th September 2019 · 3 min Read

Should I lease a car through my limited company?

This is following on from our very own Richard’s article on claiming motor expenses in your business. It is designed to cover leasing a car […]

10th September 2019 · 5 min Read

Claiming for business motor expenses

Claiming Business Vehicle Expenses: A Complete Guide Introduction You have a car, you use it for work, so you want to include it as a […]

9th September 2019 · 3 min Read

Online Accountants Reviews

In this article, we will look at the top-rated online accountants in the UK. Reviewing online accountants in the UK is not easy. You will […]

6th September 2019 · 5 min Read

A Simple VAT Guide: The Different VAT Accounting Methods

Introduction – VAT guide VAT (Value Added Tax) is a tax that businesses collect from customers on behalf of HMRC. If you’re a VAT-registered business, […]

30th August 2019 · 1 min Read

How long should you keep your records/books for?!

In this video we discuss how long you should retain your information for the taxman.

29th August 2019 · 3 min Read

Don’t manage your time, manage your energy

There is a lot of talk around how we should get more from our time and our days. Get up at 5am (I’ve started trying […]

23rd August 2019 · 5 min Read

What is the Flat Rate Scheme for VAT?

Flat rate VAT In this video Stephen Edwards discusses what the flat rate scheme is and when it may be beneficial for you to explore […]

23rd August 2019 · 3 min Read

Can I Split My Business for VAT Purposes? A Comprehensive Guide

Introduction One of the most frequently asked questions from business owners is whether they can split their business to avoid VAT registration. The short answer […]

20th August 2019 · 1 min Read

Are you happy with the profit you are making?

In this short video I talk about why we start a business for in the first place and how you can make small changes by […]

12th August 2019 · 1 min Read

Managing your time better part 1

Learn about the 80/20 rule This is a guest blog from Stephen Edwards regarding time management. We promise you, this is worth a read! You […]

5th August 2019 · 3 min Read

Cashflow challenges for tradesmen & construction sector businesses

The construction industry There are two main types within this, general builders and tradesmen and then there are more profession type workers such as surveyors […]

17th July 2019 · 4 min Read

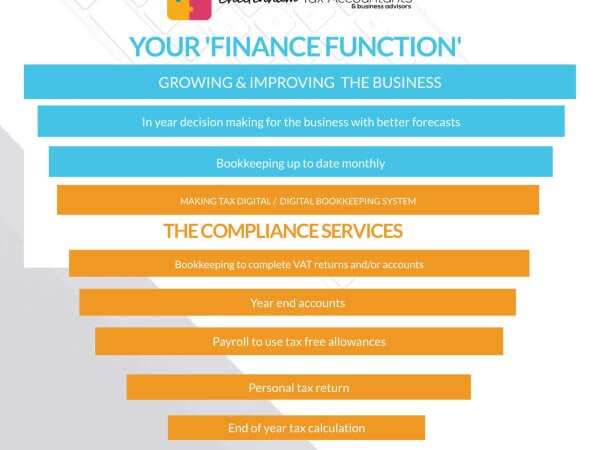

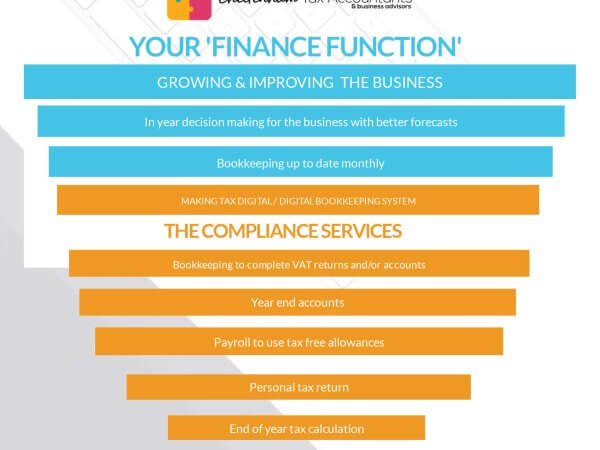

No longer just an accountant but your FINANCE FUNCTION

The world of business, bookkeeping, accounting and technology has changed dramatically in the last few years. The rate of change is set to carry on […]

9th May 2019 · 1 min Read

Xero & Quickbooks

Xero and Quickbooks online are the most popular online bookkeeping packages, but which one should you choose.

21st March 2019 · 1 min Read

5 massive end of year tax planning tips!

In this short video we share 5 massive tax tips that anyone can follow. The first one is for businesses but the rest is relevant […]

14th March 2019 · 1 min Read

New level of bookkeeping service

We are taking our bookkeeping services for our client base to a whole new level. It’s not really comparable to what we ‘had to do’ […]

1st March 2019 · 7 min Read

Tax Limited company vs Tax Sole Trader

Tax Limited Company vs Tax Sole Trader Limited company vs sole trader – Which is best for you, a limited company or a sole trader […]

8th February 2019 · 1 min Read

One of the biggest and simplest ways to save £000’s in tax!

As promised this is a biggie! Regardless of your personal or business circumstances there is one MASSIVE TAX SAVING you can potentially make and it’s […]

29th July 2018 · 3 min Read

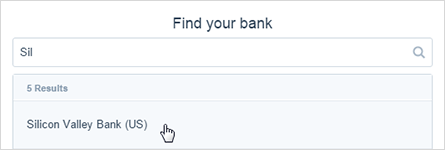

Add bank account in Xero

You can add a bank account from either the Bank Accounts screen or from the Chart of Accounts screen. Depending on the account’s bank and […]

18th July 2017 · 2 min Read

Is technology going to replace your job?

The world is changing for individuals and businesses. Technology has been fantastic for us on many fronts, such as email (apart from the spam), online […]

12th October 2016 · 2 min Read

Modern sole traders

Sole traders make up an ever increasing proportion of the workforce. Some work in creative industries – writers, media people, photographers and designers. Some as […]

7th July 2016 · 2 min Read

Online software – Xero, Sage, Quickbooks?

There has been a mad influx of cloud accounting providers to the market in recent years offering a modern solution to ‘keeping the books’. There […]

7th February 2015 · 2 min Read

How To Choose An Accountant

This is probably relevant for many industries and not just accountants, however I will share my experience on what should or may influence your decision […]

To Summarise...

We love what we do and care about your business and your money. Keeping our clients happy doesn’t just benefit you but also us, hopefully from singing our praises to friends, family and contacts…

Join the Profit First Club

Newsletter for Free

Helping entrepreneurs build a profitable and sustainable business without the stress. Insights from the UK's #1 Profit First Accountancy practice.

Subscribe

© 2025 We Are Gro Accountants

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.